In today's fast-paced financial landscape, efficiency and accuracy are paramount. For businesses dealing with leases, from equipment financing to vehicle leasing, the process of "lease origination" – from initial application to final funding – can be complex and time-consuming. This is where modern lease origination solutions step in, transforming a traditionally manual and often fragmented process into a seamless, automated workflow.

At its core, a lease origination solution is designed to manage every stage of the leasing lifecycle. This includes everything from customer relationship management (CRM) and credit assessment to document generation and portfolio management. The goal is to reduce operational costs, accelerate decision-making, and ultimately improve the customer experience.

Why Automation is Key in Lease Origination

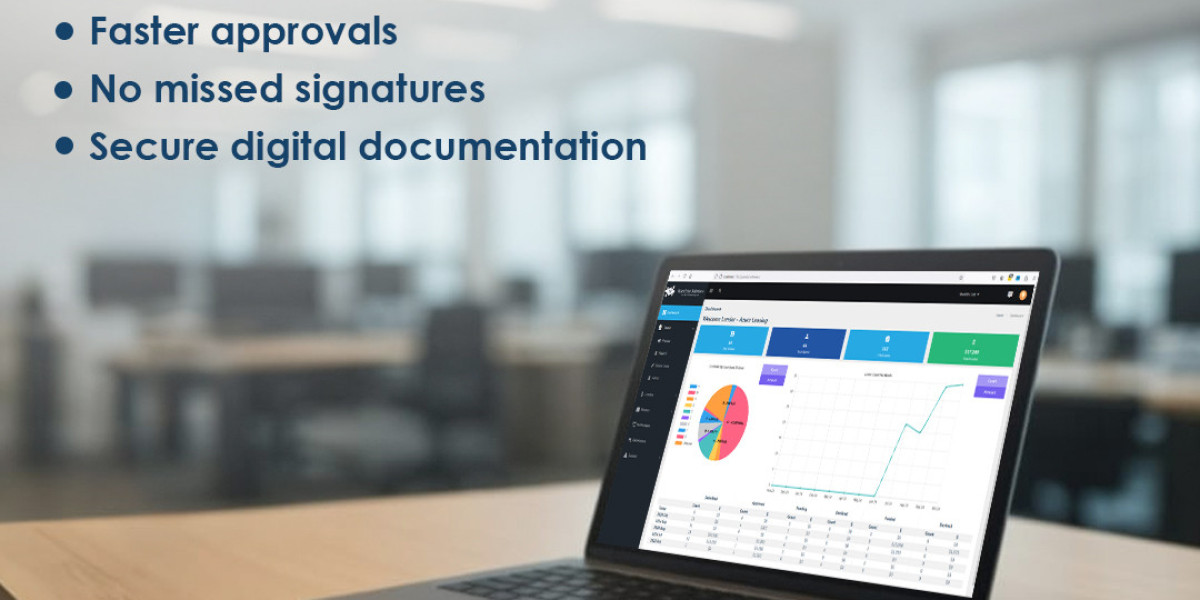

Think about the traditional approach: stacks of paperwork, manual data entry, multiple systems that don't communicate, and a high potential for human error. This not only slows down the process but also increases risk. Automated lease origination solutions address these challenges head-on. They provide a centralized platform where all information is accessible, processes are standardized, and approvals are expedited.

One of the most significant benefits is the improvement in credit decisioning. Advanced solutions integrate with credit bureaus and scoring models, providing a comprehensive view of an applicant's financial health in real-time. This allows for faster, more accurate risk assessments, leading to better-informed decisions and reduced default rates.

Beyond Leases: The Broader World of Loan Origination Software

While our focus here is on leases, it's important to understand the broader context of loan origination software. Many of the principles and functionalities apply across different types of financing. Whether it's a mortgage, a personal loan, or indeed a lease, the need for efficient processing, robust compliance, and excellent customer service remains constant.

When considering loan origination software pricing, businesses will find a wide range of options. Factors influencing cost include the number of users, the depth of features, integration capabilities, and deployment method (cloud-based vs. on-premise). It's crucial to evaluate not just the upfront cost but also the long-term return on investment, considering the time savings and error reduction.

Finding the Best Fit: Best Loan Origination Software and Companies

Identifying the best loan origination software involves a careful assessment of a company's specific needs. For large financial institutions, loan origination software for banks will need to handle high volumes, complex regulatory requirements, and integrate with a vast ecosystem of existing systems. These solutions often offer advanced analytics, fraud detection, and comprehensive compliance modules.

Conversely, small business loan origination software might prioritize ease of use, affordability, and quick implementation. Start-ups and smaller lenders benefit from solutions that can scale with their growth without requiring a massive initial investment.

The market for loan origination software companies is competitive, with many providers offering specialized solutions. Some focus exclusively on certain loan types, while others offer broad, customizable platforms. Researching vendor reputations, customer reviews, and feature sets is essential before making a decision.

Specialized Solutions: Auto Loan Origination Software

A particularly vibrant segment of the market is auto loan origination software. This specialized software streamlines the process of financing vehicle purchases, from initial application to final contract. Given the high volume and relatively quick turnaround expected in auto sales, efficient auto loan origination software is critical for dealerships and lenders alike.

The auto loan origination software market is driven by consumer demand for faster approvals and seamless digital experiences. Modern solutions in this area often include features like instant credit decisions, e-signature capabilities, and integration with dealership management systems. This not only enhances the customer experience but also significantly reduces the time and effort involved for all parties.

The Future is Automated

In conclusion, whether you're looking for comprehensive loan software for a bank, a niche solution for small business loan origination software, or specialized auto loan origination software, the benefits of adopting a robust origination solution are clear. From reducing manual effort and improving decision accuracy to enhancing customer satisfaction and ensuring compliance, these tools are no longer a luxury but a necessity for any forward-thinking lending or leasing institution. Embracing automation is the key to unlocking greater efficiency and sustained success in a competitive financial world.