Correcting any of these elements after sending payroll can need a pricey fix or a steep penalty. Even skilled HR pros might lose days getting the procedure right by hand. Outsourcing payroll, nevertheless, helps organizations guarantee their payment is accurate and compliant without drowning HR.

It works for business of all sizes. Despite less employees, it's still tough on tight HR groups - some comprised of just one person - to properly run a small company's payroll. For midsized organizations, it can be unreasonable to devote one staff member to the process (or concern an HR pro with it on top of their current duties).

Unsure if contracting out payroll is right for you? Let's explore what it entails and how it gives businesses like yours an edge.

Outsourcing payroll is the procedure of employing a third-party entity to pay:

- employees

- professionals

- tax firms

- benefits suppliers

- and more

Before this practice, it was unprecedented for companies to turn over settlement to anyone outside the organization. As tech advancement has structured payroll's more laborious jobs, nevertheless, outsourcing payroll can be more affordable.

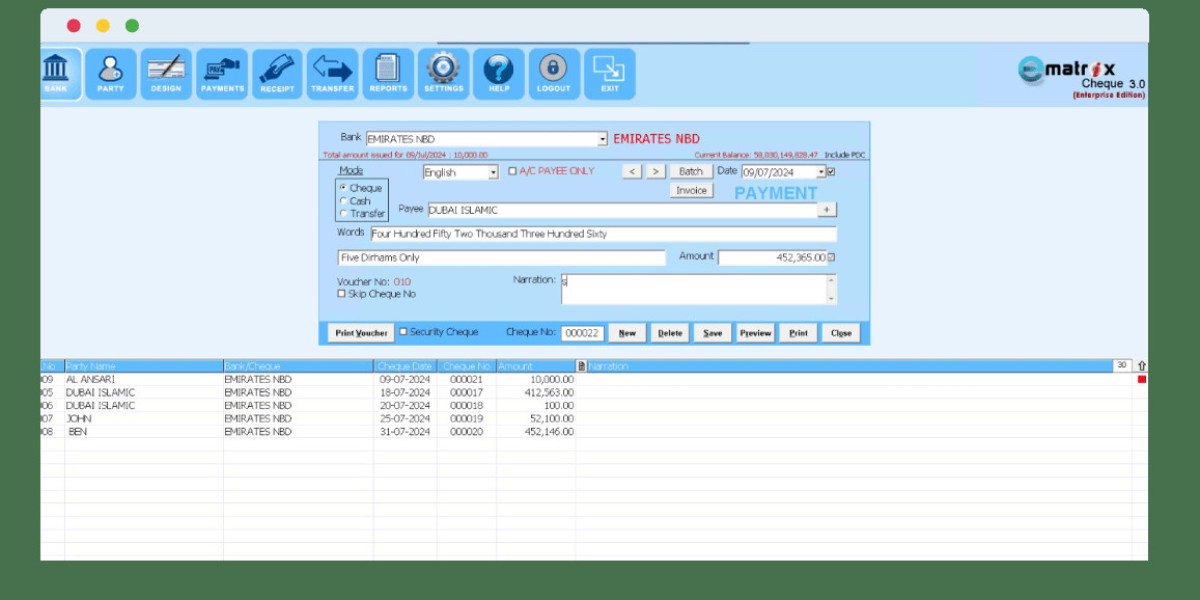

How does outsourcing payroll work?

Though not every servicer runs the same way, the normal initial step to outsourcing payroll involves entering a company's settlement information into a system or software. This information could include:

- pay rates

- positions

- employing dates

- bonus structure solutions

A group or expert also works the account. If you outsource all your HR functions, they'll likely be performed by employees of your tech supplier. Alternatively, this individual or group won't work directly for the supplier, but will have the access they need to run payroll.

Despite who's designated to the process, they most likely will not construct and finish payroll from the ground up. Instead, 3rd parties utilize tools to automate calculations and action in to manually adjust payroll as required. After all, the tech won't necessarily understand about:

- authorized PTO demands that weren't gone into

- particular repayments

- surprise benefits

- cash loan

- and more

That's why it's not unusual for a company worker - like a devoted HR pro - to verify the outsourcer's work before payroll runs. At a bare minimum, the outsourcer will notify the employer or essential stakeholders when payment heads out.

The reasons for contracting out payroll differ amongst companies, but they all come down to taking a time-consuming, error-prone process off HR's plate. This might be important for:

- small and midsized companies that do not wish to hire a full-time payroll worker

- leaders who desire to focus employees' time on income and advancement

- companies that desire their HR pros to concentrate on people, not an arduous payroll procedure

- companies seeking compliance comfort from external professionals certified to guarantee accuracy of taxes, reductions and benefits contributions

- fast-growing companies that do not wish to run the risk of noncompliance or error as they scale

But these specify situations. The advantages to utilizing payroll outsourcing business extend further than just a stage of your organization's growth.

What are the pros of contracting out payroll?

The most significant benefits of contracting out payroll involve:

- reducing bias

- lower costs

- accuracy

- efficiency

- compliance

For example, a tight-knit business experiencing over night growth may not be prepared - or perhaps know how - to compensate brand-new workers fairly. An unbiased 3rd party, however, will not succumb to favoritism or ethical predicaments, since the right service provider figures out that with a benefit matrix that rewards employees for performance.

Outsourcing payroll likewise translates to a lower threat of mistakes and compliance infractions. Instead of managing every law internally, you can put that issue in the hands of a real compliance expert. At least, outsourcing payroll lets you unload this crucial job without needing to employ your own specialist with a full-time income.

A payroll mistake costs $291 typically per Ernst & Young. Paycom assists organizations prevent mistakes and their staggering effects.

Outsourcing payroll pulls HR pros out of the administrative trenches and empowers them to concentrate on value-adding work, including:

- operations

staff member retention methods

- recruitment

- compliance unassociated to payroll

- other areas affecting the bottom line

What are the finest practices for contracting out payroll?

Finding the ideal payroll vendor can be daunting. But you can make the right option if you know what to look for. Here are a few tips for outsourcing payroll with confidence.

Find a payroll outsourcer that lines up with your company

An advanced tech business does not do the very same thing as a popular restaurant. Why would their payroll needs be the exact same?

While a single software application might cover both their needs, those companies initially would require to recognize what matters to them most. The tech business might be more worried with an easy-to-use, configurable user interface. The restaurant, however, would need its payroll vendor to also:

- handle timekeeping and scheduling

- represent changing head count

- integrate with its point-of-sale tech for easier tip tracking

For a better staff member experience in general, you need a service provider that handles more than simply payroll - preferably in a single software. With simply one login and password, staff members can access all the HR data they need, like:

- pay stubs

- time-off balances

- organizational charts

- advantages and open enrollment

- training courses

Most of all, do not choose an excessively rigid vendor. The very best payroll companies will work with HR - not against it - to discover the best procedure.

Keep some control

Yes, a payroll vendor can deal with a massive problem. This does not mean you need to see every piece of the procedure, however you should never ever be eliminated of it completely. Ask your prospective provider about your level of payroll oversight.

This does not imply run your own payroll while you're outsourcing it. Think of it as keeping a backup instead. For example, run a mock payroll for a worker who has a more intricate circumstance. Then, whenever you're asked to authorize payroll, inspect how the vendor processed the staff member in question. Different figures does not instantly mean they're wrong; you simply require to determine who's right.

Communicate with employees

By contracting out payroll, you're entrusting a 3rd party with the information that matters most to workers. They should understand what's occurring and have a chance to ask questions. If they have any problems about their pay, the provider must have a clear resolution technique.

To this end, assign administrative workers to function as an intermediary between your workforce and the payroll processor.

Why should services outsource payroll to Paycom?

Paycom helps you handle not simply payroll, however all HR functions, right in our single software application. This suggests staff members don't need to hop in between disjointed systems to access the information they need. Meanwhile, HR can focus on individuals through retention and culture efforts.

Our tech gives you the ideal balance of control and automation. In truth, Beti ®, Paycom's employee-guided payroll experience, instantly discovers mistakes Then, it guides your people to fix them before payroll submission, all in the Paycom app. As an outcome, Beti:

- gets rid of expensive payroll mistakes.

- decreases your business's liability

- engages workers with their pay

- simplifies keeping track of payroll

HR personnel stay involved in the procedure, but they don't have to dig through the weeds or hope payroll's right - they understand it is.

Explore Beti to find out why it's the perfect choice for contracting out payroll to Paycom.

DISCLAIMER: The details supplied herein does not make up the arrangement of legal suggestions, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as an alternative for assessment with professional legal, tax, accounting or other professional advisers. Before making any choice or taking any action, you need to speak with a professional consultant who has been provided with all relevant facts pertinent to your specific scenario and for your particular state(s) of operation.